florida inheritance tax amount

As a result no portion of what you leave to your family will go to. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the.

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

The federal estate tax exemption for 2021 is 117 million.

. Find Everything about Florida inheritance tax and Start Saving Now. Ad Search for florida inheritance tax. Connect With Experienced Local Inheritance Estate Lawyers.

There are several other tax filings that the survivor must complete and they include the. Federal Estate Tax. There is no estate tax in Florida as it was repealed in 2004.

They can have an. If you have questions or need experienced legal counsel in Palm Beach County dont hesitate to contact our law. While Florida does not have an inheritance tax there is a federal inheritance tax.

Doane Doane specializes in tax matters and other areas of law. The estate tax exemption is adjusted for inflation every year. The size of the estate tax exemption means very few fewer.

Any amount up to 117 million is. If you live in the State of Florida you should know if there is a Florida inheritance tax before you create your estate plan. Florida residents may still pay federal estate taxes though.

An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no. Florida residents are fortunate in that.

Although the state of Florida does not assess an inheritance tax or an estate levy Florida doesnt charge one. A Brief History of Inheritance Taxation. However this tax only applies to large estates in excess of 117 million.

Ad 100 Free Consultation. Keep reading to discover more about probate inheritance tax in Florida. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or.

Heres a breakdown of each states inheritance tax rate ranges. No Florida estate tax is due for decedents who died on or after January 1 2005. Florida Inheritance Tax and Gift Tax.

Discover All Useful Info. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or.

You can contact us. Florida inheritance tax is limited to an amount allowed as a deduction from the federal state tax. The laws surrounding inheritance and estate taxes in Florida are complex and it could be hard to understand your options without the assistance of an inheritance attorney.

Talk To A Local Expert. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or. Just because Florida does not have an inheritance tax does not mean you do not have to file taxes.

Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. For 2016 the gift. Thus each US citizen is entitled to exempt the set amount from estate taxation on assets held in.

There is a 25000. Of Revenue Tax Information Services 1379 Blountstown Highway.

Florida Estate Tax Everything You Need To Know Smartasset

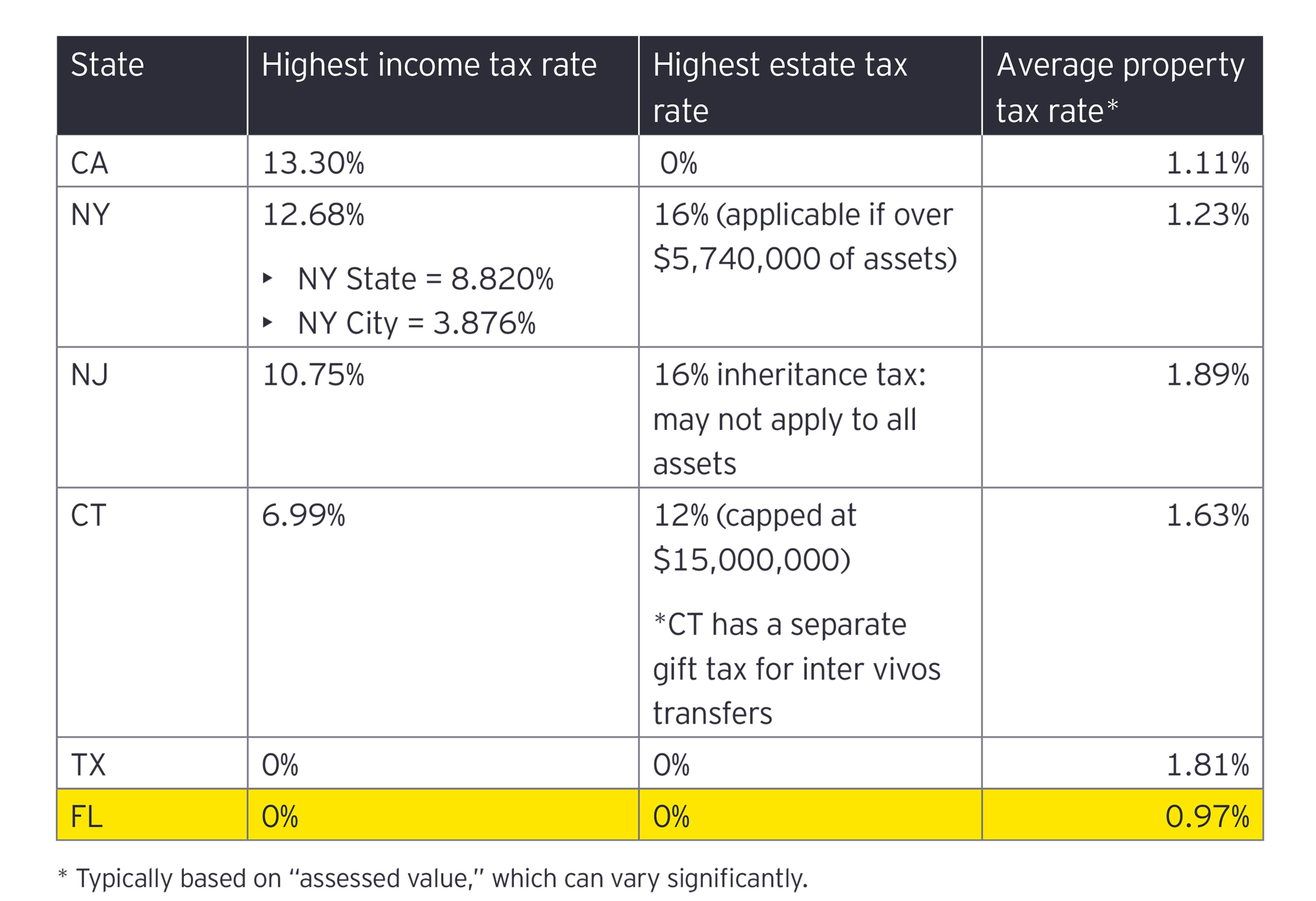

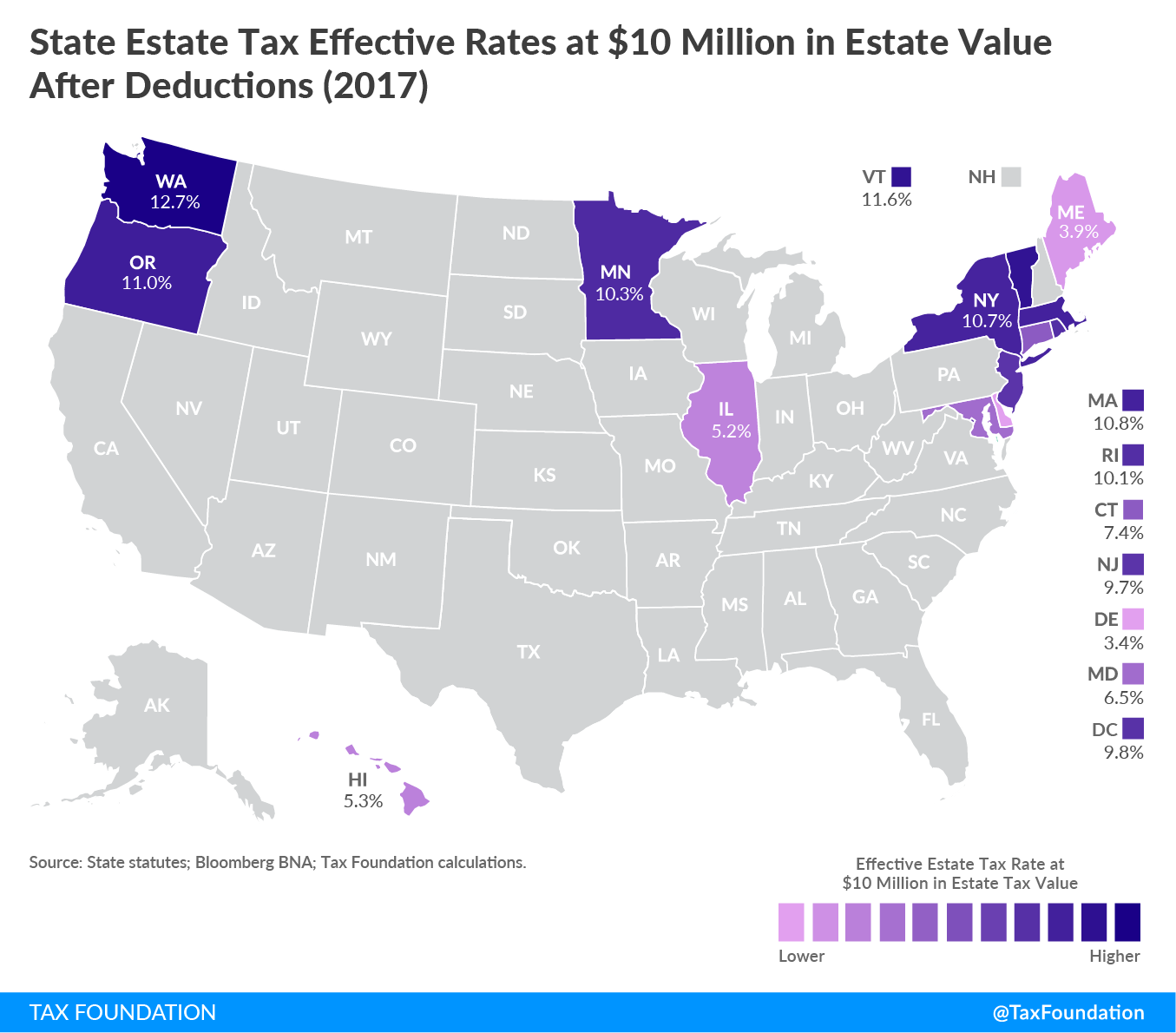

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Estate Tax In The United States Wikipedia

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Inheritance Tax How It Works And Who S Exempt Magnifymoney

Estate Tax In The United States Wikipedia

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Legal Advice To Avoid Taxes On Inheritance

What Is The U S Estate Tax Rate Asena Advisors

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

The Best Place To Die From An Estate And Inheritance Tax Perspective

Does Florida Have An Inheritance Tax Alper Law

What Is Inheritance Tax Probate Advance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Truth About The Florida Inheritance Tax St Lucie County Fl Estate Planning Attorneys